Exhibit 99.2

3710 – 33rd Street NW, Calgary, Alberta, Canada T2L 2M1

T + 1 403 455 7727 | xortx.com | TSXV / NASDAQ : XRTX

MANAGEMENT INFORMATION CIRCULAR

FOR THE ANNUAL & SPECIAL MEETING OF THE HOLDERS OF COMMON SHARES

OF XORTX THERAPEUTICS INC. TO BE HELD ON JUNE 28, 2023

Dated May 16, 2023

GENERAL PROXY INFORMATION

Solicitation of Proxies

This management information circular (“Management Information Circular”) is furnished in connection with the solicitation of proxies by the management and the directors of XORTX Therapeutics Inc. (“XORTX” or the “Company”) for use at the annual and special meeting of the shareholders (the “Shareholders”) of the Company (the “Meeting”) to be held at the offices of the Company at 3710 – 33rd Street NW, Calgary, Alberta at 10:00 a.m. (Calgary time) on Wednesday, June 28, 2023, and at all adjournments thereof for the purposes set forth in the accompanying notice of the Meeting (the “Notice of Meeting”). The solicitation of proxies will be made primarily by mail and may be supplemented by telephone or other personal contact by the directors, officers and employees of the Company. Directors, officers and employees of the Company will not receive any extra compensation for such activities. The Company may also retain, and pay a fee to, one or more professional proxy solicitation firms to solicit proxies from the Shareholders in favour of the matters set forth in the Notice of Meeting. The Company may pay brokers or other persons holding common shares of the Company (“Common Shares”) in their own names, or in the names of nominees, for their reasonable expenses for sending proxies and this Management Information Circular to beneficial owners of Common Shares and obtaining proxies therefrom. The cost of the solicitation will be borne directly by the Company.

No person is authorized to give any information or to make any representation other than those contained in this Management Information Circular and, if given or made, such information or representation should not be relied upon as having been authorized by the Company. The delivery of this Management Information Circular shall not, under any circumstances, create an implication that there has not been any change in the information set forth herein since the date hereof.

This Management Information Circular is being sent to both registered and non-registered owners of the Common Shares.

Non-Registered Shareholders

Only registered Shareholders, or the persons they appoint as their proxies, are entitled to attend and vote at the Meeting. However, in many cases, Common Shares beneficially owned by a person (a “Non-Registered Shareholder”) are registered either:

| (a) | in the name of an intermediary (an “Intermediary”) with whom the Non-Registered Shareholder deals in respect of the Common Shares (Intermediaries include, among others: banks, trust companies, securities dealers or brokers, trustees or administrators of a self-administered registered retirement savings plan, registered retirement income fund, registered education savings plan and similar plans); or |

| 2 |

| (b) | in the name of a clearing agency (such as The Canadian Depository for Securities Limited in Canada, and the Depository Trust Company in the United States) of which the Intermediary is a participant. |

In accordance with the requirements of National Instrument 54-101 of the Canadian Securities Administrators, the Company has distributed copies of the Notice of Meeting, this Management Information Circular and its form of proxy (collectively the “Meeting Materials”) to the Intermediaries and clearing agencies for onward distribution to Non-Registered Shareholders. Intermediaries are required to forward the Meeting Materials to Non-Registered Shareholders unless the Non-Registered Shareholders have waived the right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Shareholders. Generally, Non-Registered Shareholders who have not waived the right to receive Meeting Materials will either:

| (a) | be given a voting instruction form which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “voting instruction form”) which the Intermediary must follow.; Most brokers delegate responsibility for obtaining instructions from clients to Broadridge Financial Services (Broadridge). Broadridge mails a voting instruction form (“VIF”) in lieu of a proxy provided by the Company. The completed VIF must be returned by mail (using the return envelope provided) or by facsimile. Alternatively, Non-Registered Shareholders may call a toll-free number or go online to www.proxyvote.com to vote; or |

| (b) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the form of proxy and deposit it with TSX Trust Company, 100 Adelaide Street West, Suite 301, Toronto, Ontario, Canada, M5H 4H1. |

The purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the Common Shares they beneficially own.

Should a Non-Registered Shareholder who receives either a voting instruction form or a form of proxy wish to attend the Meeting and vote in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should strike out the names of the persons named in the form of proxy and insert the Non-Registered Shareholder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the directions indicated on the form. In either case, Non-Registered Shareholders should carefully follow the instructions of their Intermediaries and their service companies, including those regarding when and where the voting instruction form or the proxy is to be delivered.

Appointment and Revocation of Proxies

The persons named in the form of proxy accompanying this Management Information Circular are directors and/or officers of the Company. A shareholder of the Company has the right to appoint a person or company (who need not be a shareholder), other than the persons whose names appear in such form of proxy, to attend and act for and on behalf of such shareholder at the Meeting and at any adjournment thereof. Such right may be exercised by either striking out the names of the persons specified in the form of proxy and inserting the name of the person or company to be appointed in the blank space provided in the form of proxy, or by completing another proper form of proxy and, in either case, delivering the completed and executed proxy to TSX Trust Company in time for use at the Meeting in the manner specified in the Notice of Meeting.

| 3 |

A registered shareholder of the Company who has given a proxy may revoke the proxy at any time prior to use by: (a) depositing an instrument in writing, including another completed form of proxy, executed by such registered shareholder or by his or her attorney authorized in writing or by electronic signature or, if the registered shareholder is a corporation, by an officer or attorney thereof properly authorized, either: (i) at the office of the Company, 3710 – 33rd Street NW, Calgary, Alberta, Canada T2L 2M1 at any time prior to 10:00 a.m. (Calgary time) on the second last business day preceding the day of the Meeting or any adjournment thereof; (ii) with TSX Trust Company, 100 Adelaide Street West, Suite 301, Toronto, Ontario, Canada, M5H 4H1 at any time prior to 12:00 p.m. (Toronto time) on the second last business day preceding the day of the Meeting or any adjournment thereof; or (iii) with the chairman of the Meeting on the day of the Meeting or any adjournment thereof; (b) transmitting, by telephone or electronic means, a revocation that complies with paragraphs (i), (ii) or (iii) above and that is signed by electronic signature, provided that the means of electronic signature permits a reliable determination that the document was created or communicated by or on behalf of such shareholder or by or on behalf of his or her attorney, as the case may be; or (c) in any other manner permitted by law including attending the Meeting in person.

Only Registered Shareholders have the right to revoke a proxy. A Non-Registered Shareholder who has submitted a proxy can change their vote by contacting the Intermediary through which the Non-Registered Shareholder’s Common Shares are held in sufficient time prior to the Meeting to arrange to change the vote and, if necessary, revoke the proxy.

Exercise of Discretion by Proxies

The Common Shares represented by an appropriate form of proxy will be voted or withheld from voting on any ballot that may be conducted at the Meeting, or at any adjournment thereof, in accordance with the instructions of the shareholder thereon. In the absence of instructions, such Common Shares will be voted for each of the matters referred to in the Notice of Meeting as specified thereon.

The enclosed form of proxy, when properly completed and signed, confers discretionary authority upon the persons named therein to vote on any amendments to or variations of the matters identified in the Notice of Meeting and on other matters, if any, which may properly be brought before the Meeting or any adjournment thereof. At the date hereof, management of the Company knows of no such amendments or variations or other matters to be brought before the Meeting. However, if any other matters which are not now known to management of the Company should properly be brought before the Meeting, or any adjournment thereof, the Common Shares represented by such proxy will be voted on such matters in accordance with the judgment of the person named as proxy therein.

Signing of Proxy

The form of proxy must be signed by the shareholder of the Company or the duly appointed attorney of the shareholder of the Company authorized in writing or, if the shareholder of the Company is a corporation, by a duly authorized officer of such corporation. A form of proxy signed by the person acting as attorney of the shareholder of the Company or in some other representative capacity, including an officer of a corporation which is a shareholder of the Company, should indicate the capacity in which such person is signing and should be accompanied by the appropriate instrument evidencing the qualification and authority to act of such person, unless such instrument has previously been filed with the Company. A shareholder of the Company or his or her attorney may sign the form of proxy or a power of attorney authorizing the creation of a proxy by electronic signature provided that the means of electronic signature permits a reliable determination that the document was created or communicated by or on behalf of such shareholder or by or on behalf of his or her attorney, as the case may be.

| 4 |

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Description of Share Capital

The Company is authorized to issue an unlimited number of Common Shares. Each Common Share entitles the holder of record thereof to one vote per Common Share at all meetings of the Shareholders. As at the close of business on May 16, 2023, there were 17,989,687 Common Shares outstanding.

Record Date

The directors of the Company have fixed May 15, 2023 as the record date for the determination of the Shareholders entitled to receive notice of the Meeting. Shareholders of record at the close of business on May 15, 2023, will be entitled to vote at the Meeting and at all adjournments thereof.

Ownership of Securities of the Company

As at May 16, 2023, to the knowledge of the directors and officers of the Company, as at the date of this Management Information Circular, no individual or corporation beneficially owns, directly or indirectly, or exercises control or direction over, voting securities of the Company carrying more than 10% of the voting rights attached to any class of voting securities of the Company.

PARTICULARS OF MATTERS TO BE ACTED UPON

1. PRESENTATION OF FINANCIAL STATEMENTS

At the Meeting, the Chairman of the Meeting will present to Shareholders the audited consolidated financial statements of the Company for the year ended December 31, 2022 and the auditor's report thereon.

2. ELECTION OF DIRECTORS

The board of directors (the “Board”) currently consists of seven (7) members. The table and the notes thereto state the names of all persons nominated by management for election as directors, all other positions and offices with the Company now held by them, their principal occupations or employment, the period or periods of service as directors of the Company and the approximate number of voting securities of the Company beneficially owned, directly or indirectly, or over which control or direction is exercised by each of them as of the date hereof. Each director of the Company holds office until his successor is elected at the next meeting of the Company, or any adjournment thereof, or until his or her successor is elected or appointed.

| 5 |

| Name, Province or State and Country of Residence | Position with the Company | Director of the Company Since |

Principal Occupation for Five Preceding Years |

# of Common Shares Owned or Controlled(1) |

|

Anthony J. Giovinazzo Ontario, Canada |

Non-Executive Chair | June 6, 2022 | Lead Independent Director, Titan Medical Inc. (since September 2020); Executive Chair, Kalgene Inc., a private company; former Director and CEO (November 2009 to March 2017), Cynapsus Therapeutics Inc., a TSX and Nasdaq listed company, that was acquired in an all-cash transaction with Sunovion Pharmaceuticals Inc. for CAD $841 million. Former Director, ProMIS Neurosciences Inc. (March 2017 to September 2020), Pond Technologies Holdings Inc. (October 2020 to June 2021); and Microbix Biosystems Inc. (December 2020 to March 2022). |

Nil Common Shares

150,000 Options |

| Dr. Allen Davidoff Alberta, Canada |

Director, President and Chief Executive Officer | January 9, 2018 | Current President and Chief Executive Officer of the Company since January 9, 2018 and its predecessor company, XORTX Pharma Corp. since July 2012; former Chief Scientific Officer and co-founder, Stem Cell Therapeutics Inc. (November 2004 to December 2011). |

467,617 Common Shares

157,411 Options |

|

William Farley (2)(4) New York, USA |

Director | May 12, 2021 | Over 35 years’ experience in business development, sales and leading efforts in drug discovery, development and partnering. Current Vice President, Business Development, Sorrento Therapeutics, Inc. and its subsidiary companies Levena BioPharma Co., Ltd. and Scilex Pharmaceutics, Inc. as well as its Sofusa division since 2016 and current Director, Globestar Therapeutics Corporation since April 2021. |

Nil Common Shares

65,000 Options |

| 6 |

| Ian Klassen (2*)(3) British Columbia, Canada |

Director | August 27, 2020 | Director and CEO, Grande Portage Resources Ltd. since March 2006; Director and CEO, GMV Minerals Inc. since December 2007; Director ExeBlock Technology Corporation since September 2017 and currently its Interim CEO; former Director of Canabo Medical Corp., now Aleafia Health Inc. (March 2014 to March 2018), G6 Materials Corp. (January 2012 to May 2016); Sixty North Gold Mining Ltd. (July 2017 to September 2019) and Transcanna Holdings Inc. (August 2019 to March 2020). |

42,759 Common Shares

80,000 Options

|

|

Jacqueline Le Saux (3)(4*) Ontario, Canada |

Director | June 16, 2021 | Retired, experienced Canadian health care legal executive focused on securities, pharmaceutical regulatory and intellectual property law. Former Vice President, Legal and Compliance, Purdue Pharma (Canada) (2009 to 2018). |

Nil Common Shares

65,000 Options |

| Raymond Pratt (4) Maryland, USA |

Director | December 20, 2021 | Current Chief Medical Officer, Savara, Inc. since November 2022 and Principal, RDP Pharma Consulting since April 2022; former Chief Development Officer and Chief Medical Officer, Rockwell Medical, Inc. (2012 – 2022). |

Nil Common Shares

60,000 Options |

|

Paul Van Damme (2)(3*) Ontario, Canada |

Director | January 25, 2018 | Former Director, OncoQuest Inc., a subsidiary of Quest PharmaTech Inc. (November 2015 to February 2020); former Chief Financial Officer, Mind Medicine (MindMed) Inc. (August 2019 to April 2020); Structural Genomics Consortium (May 2012 to June 2019); Bradmer Pharmaceuticals Inc. (September 2007 to July 2018) and Galaxy Digital Holdings Ltd. (September 2007 to July 2018). |

63,993 Common Shares

77,224 Options

|

|

Notes: (1) The information as to Common Shares beneficially owned, not being within the knowledge of the Company, has been furnished by directors individually. (2) Member of the Compensation Committee. (3) Member of the Audit Committee. (4) Member of the Corporate Governance and Nominating Committee. * Denotes Chair. | ||||

As at the date of this Management Information Circular, the directors and senior officers of the Company as a group, directly and indirectly, beneficially own or exercise control or direction over 582,869 Common Shares, representing approximately 3.2% of the issued and outstanding Common Shares.

| 7 |

Other than as noted below, none of the directors or executive officers:

| (a) | is, as at the date of this Management Information Circular, or was within 10 years before the date of this Management Information Circular, a director or chief executive officer or chief financial officer of any company that: |

| (i) | was the subject of an order (as defined in National Instrument 51-102F5) that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an order that was issued after the director or executive officer ceased to be a director, chief executive officer, or chief financial officer, and which resulted from an event that occurred while that person was acting in the capacity as a director, chief executive officer, or chief financial officer. |

None of the directors, executive officers or a shareholder holding a sufficient number of securities of the Company to affect materially the control of the Company:

| (a) | is at the date hereof, or has been within 10 years before the date of this Management Information Circular, a director or executive officer of any company that while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (b) | has, within the 10 years before this Management Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director, executive officer or shareholder. |

Majority Voting for Directors

The Board has adopted a majority voting policy (the “Majority Voting Policy”) stipulating that each director nominee must be elected by a majority of the votes cast by Shareholders with respect to his or her election. If a director nominee is not elected by at least a majority of the votes cast, the nominee will submit his or her resignation promptly after the shareholders’ meeting to the Chairman of the Board, which will become effective only upon acceptance by the Board. The Board will consider such resignation, all factors considered relevant by the Board, including without limitation, the stated reasons (if any) why Shareholders withheld votes from the election of that director nominee, the effect such resignation may have on the Company’s ability to comply with applicable corporate or securities law requirements, the Company’s other corporate governance policies, applicable regulations or commercial agreements regarding the composition of the Board, the dynamics of the Board and any applicable stock exchange’s listing standards. Within 90 days of the shareholders’ meeting, the Board will decide whether or not to accept the resignation. A director who tenders a resignation pursuant to the Majority Voting Policy is not permitted to participate in any meetings of the Board or committee of the Board at which his or her resignation is being considered. Once the Board has decided whether to accept a resignation pursuant to the Majority Voting Policy, the Company will promptly issue a news release with the Board’s decision and provide a copy to the TSX Venture Exchange (the “TSXV”). In the event the Board does not accept a resignation, it will include full reasons for its decision in the news release. The Majority Voting Policy does not apply in circumstances involving contested director elections. A copy of the Majority Voting Policy is available on the Company’s website at https://www.xortx.com/investors/corporate-governance.

Proxies received in favour of management will be voted FOR the election of the above-named nominees, unless the shareholder has specified in the proxy that the Common Shares are to be withheld from voting in respect thereof. Management has no reason to believe that any of the nominees will be unable to serve as a director but, if a nominee is for any reason unavailable to serve as a director, proxies in favour of management will be voted in favour of the remaining nominees and may be voted for a substitute nominee unless the shareholder has specified in the proxy that the Common Shares are to be withheld from voting in respect of the election of directors.

| 8 |

3. Appointment of Auditor

Shareholders will be asked to consider and, if thought advisable, to pass an ordinary resolution to appoint the firm of Smythe LLP Chartered Professional Accountants ("Smythe"), to serve as the auditor of the Company until the next annual meeting of Shareholders and to authorize the directors of the Company to fix the auditor's remuneration as such. Smythe (formerly Morgan & Company LLP) was retained as auditor of the Company's predecessor XORTX Pharma Corp. and continued as auditor effective January 9, 2018, the date of the reverse take-over between APAC Resources Inc. and XORTX Pharma Corp. to form XORTX Therapeutics Inc.

Unless the shareholder directs that his or her Common Shares are to be withheld from voting in connection with the appointment of the auditor, the persons named in the enclosed form of proxy intend to vote FOR the re-appointment of SMYTHE LLP CHARTERED PROFESSIONAL ACCOUNTANTS to serve as auditor of the Company until the next annual meeting of Shareholders and to authorize the Directors to fix their remuneration.

4. Approval of Stock Option Plan

The Company maintains a Stock Option Plan (the "Option Plan") for the benefit of directors, officers, employees, consultants and other service providers of the Company and its subsidiaries in order to assist the Company in attracting, retaining and motivating such persons by providing them with the opportunity, through stock options ("Options"), to acquire an increased proprietary interest in the Company.

The Option Plan authorizes the issuance of Options up to an aggregate of 10% of the issued Common Shares from time to time. There are currently 17,989,687 Common Shares of the Company issued and outstanding, and therefore the current 10% threshold is 1,798,969 Common Shares available for Options grants under the Option Plan. Options may be granted under the Option Plan with a maximum exercise period of up to ten (10) years, as determined by the Board of the Company.

The Option Plan limits the number of Options which may be granted to any one individual to not more than 5% of the total issued Common Shares in any 12 month period (unless otherwise approved by the disinterested Shareholders), and not more than 10% of the total issued Common Shares to all insiders at any time or granted over any 12 month period. The number of Options granted to any one consultant or person employed to provide investor relations activities in any 12 month period must not exceed 2% of the total issued Common Shares. Any Options granted under the Option Plan will not be subject to any vesting schedule, unless otherwise determined by the Board.

Options under the Option Plan may be granted at an exercise price which is at or above the current discounted market price on the date of the grant. In the event of the death or permanent disability of an optionee, any Option granted to such optionee will be exercisable upon the earlier of 365 days from the date of death or permanent disability, or the expiry date of the option. In the event of the resignation, or the termination or removal of an optionee without just cause, any Option granted to such optionee will be exercisable for a period of 90 days thereafter. In the event of termination for cause, any Option granted to such optionee will be cancelled as at the date of termination.

A copy of the Option Plan, updated to reflect the Company’s listing on the TSXV, is attached as Schedule C to this Management Information Circular.

As of May 16, 2023, Options to purchase an aggregate of 1,039,335 Common Shares are outstanding under the Option Plan leaving a balance of 759,634 Options available for issuance under the Option Plan.

| 9 |

Shareholders are being asked to re-approve and confirm the Option Plan. In order to confirm and re-approve the Option Plan a majority of votes cast at the meeting must be voted in favour of the Option Plan.

Accordingly, Shareholders will be asked to approve the following resolution:

"BE IT RESOLVED THAT the Company's Plan as described in the Management Information Circular dated May 16, 2023, be and it is hereby adopted, confirmed and approved, including that the maximum number of Common Shares reserved for issuance under the Option Plan at any given time is equal to ten percent (10%) of the issued and outstanding Common Shares at the date of grant of an Option under the Option Plan."

The Board recommends that the Company's Shareholders vote FOR the approval of the Option Plan.

Unless a shareholder directs that his or her common shares are to be voted AGAINST THE APPROVAL OF THE OPTION PLAN THE PERSONS NAMED IN THE ENCLOSED FORM OF PROXY INTEND TO VOTE FOR THE APPROVAL OF THE OPTION PLAN.

OTHER MATTERS WHICH MAY COME BEFORE THE MEETING

The management knows of no matters to come before the Meeting other than as set forth in the Notice of Meeting. However, if other matters which are not known to the management should properly come before the Meeting, the accompanying proxy will be voted on such matters in accordance with the best judgment of the persons voting the proxy.

COMPENSATION OF DIRECTORS

Non-Executive Directors’ Fees

During the period ended December 31, 2022, other than Anthony Giovinazzo who is paid US$125,000 for Chairman services, the non-executive directors of the Company received an annual fee of $12,000 and for each meeting exceeding 30 minutes, each committee chair received a fee of $700 and each member of a committee received a fee of $300 for director services. No bonuses were paid by the Company to its directors for the year ended December 31, 2022.

Each member of our Board is entitled to reimbursement for reasonable travel and other expenses incurred in connection with attending board meetings and meetings for any committee on which he or she serves.

| 10 |

Director Compensation Table

The following table provides information regarding compensation paid to the non-executive directors of the Company in respect of the financial year ended December 31, 2022. Compensation disclosure relating to Allen Davidoff, who is both a director and a Named Executive Officer, is disclosed under the heading “Statement of Executive Compensation – Summary Compensation Table”.

|

Director

|

Fees ($) |

Share-Based

($) |

Option-

($) |

Non-Equity ($) |

Pension Value ($) |

All Other Compen-sation ($) |

Total ($) |

| William Farley | 13,800 | N/A | 36,326 | Nil | Nil | Nil | 50,126 |

| Anthony Giovinazzo(2) | 86,154 | N/A | 181,628 | N/A | N/A | N/A | 267,782 |

| Ian Klassen | 16,600 | N/A | 36,326 | Nil | Nil | Nil | 52,926 |

| Jacqueline Le Saux | 16,600 | N/A | 36,326 | Nil | Nil | Nil | 50,826 |

| Raymond Pratt | 12,600 | N/A | 36,326 | Nil | Nil | Nil | 48,926 |

| Paul Van Damme | 17,400 | N/A | 36,326 | Nil | Nil | Nil | 53,726 |

Notes:

| (1) | Directors’ fees are earned in Canadian dollars. |

| (2) | Anthony Giovinazzo was appointed to the Board on June 6, 2022. |

Share-Based Awards and Option-Based Awards

The following table sets forth information with respect to all outstanding share-based and option-based awards to directors who are not Named Executive Officers as at December 31, 2022.

| Option-based Awards | Share-based Awards | ||||||

| Name | Number of Securities Underlying Unexercised Options (#)(1) |

Option Exercise Price ($) |

Option Expiration Date |

Value of Unexercised In-the-Money Options(2) ($) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share- based awards that have not vested ($) |

Market or payout value of vested share- based awards not paid out or distributed ($) |

| William Farley |

21,294 13,706 30,000 |

1.88 2.54 1.60 |

May 12, 2026 Dec 21, 2026 Jun 06, 2027 |

Nil | N/A | N/A | N/A |

| Anthony Giovinazzo (3) | 150,000 | 1.60 | Jun 06, 2027 | Nil | N/A | N/A | N/A |

| Ian Klassen |

12,776 29,812 7,412 30,000 |

2.82 3.29 2.54 1.60 |

Aug 27, 2025 Jan 11, 2026 Dec 21, 2026 Jun 06, 2027 |

Nil | N/A | N/A | N/A |

| Jacqueline Le Saux |

21,294 13,706 30,000 |

1.76 2.54 1.60 |

Jun 16, 2026 Dec 21, 2026 Jun 06, 2027 |

Nil | N/A | N/A | N/A |

| Raymond Pratt | 30,000 | 2.54 | Dec 21, 2026 | Nil | N/A | N/A | N/A |

| Paul Van Damme |

25,553 21,671 30,000 |

1.64 2.54 1.60 |

Jun 23, 2025 Dec 21, 2026 Jun 06, 2027 |

Nil | N/A | N/A | N/A |

Notes:

| (1) | Options granted to directors are typically not subject to vesting. |

| (2) | Calculated based on the closing price of the Company’s Shares of C$1.12 on December 31, 2022, the last trading day of the financial year. |

| 11 |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth information in respect of the value of awards under the Option Plan to directors that vested during the financial year ended December 31, 2022 and bonuses awarded to directors, for the financial year ended December 31, 2022.

| Name | Option-Based Awards - Value Vested During Year(1)(2) (C$) |

Share-Based Awards - Value Vested During Year(3) (C$) |

Non-Equity Incentive Plan Compensation- Value Earned During Year (C$) |

| William Farley | Nil | N/A | N/A |

| Anthony Giovinazzo (4) | Nil | N/A | N/A |

| Ian Klassen | Nil | N/A | N/A |

| Jacqueline Le Saux | Nil | N/A | N/A |

| Raymond Pratt | Nil | N/A | N/A |

| Paul Van Damme | Nil | N/A | N/A |

Notes:

| (1) | This amount is the dollar value that would have been realized if the options held by such individual had been exercised on the vesting date(s). This amount is computed by obtaining the difference between the market price of the underlying securities at exercise and the exercise or base price of the options under the option-based award on the vesting date. |

| (2) | The actual value of the options granted to the director will be determined based on the market price of the Common Shares at the time of exercise of such options, which may be greater or less than the value at the date of vesting reflected in the table above. |

| (3) | This amount is the dollar value realized computed by multiplying the number of Common Shares by the market value of the underlying Common Shares on the vesting date. |

STATEMENT OF EXECUTIVE COMPENSATION

In accordance with NI 51-102 and the related form requirements, this Management Information Circular includes certain comparative data and information for prescribed prior years.

The following Compensation Discussion and Analysis is intended to provide information about the Company’s philosophy, objectives and processes regarding compensation for the executive officers of the Company. It explains how decisions regarding executive compensation are made and the reasoning behind these decisions.

Compensation Philosophy and Objectives of Compensation Programs

Introduction

The following section describes the significant elements of the Company’s executive and director compensation program. The Named Executive Officers for the year ended December 31, 2022 include Allen Davidoff, CEO, Amar Keshri, CFO and Stephen Haworth, CMO.

Overview

Compensation Philosophy

The goal of our compensation program is to attract, retain and motivate our employees and executives. The Board and our Compensation Committee are responsible for setting our executive compensation and establishing corporate performance objectives. In considering executive compensation, the Board strives to ensure that our total compensation is competitive within the industry in which we operate and supports our overall strategy and corporate objectives. The combination of base salary, annual incentives and long-term incentives that we provide our executive officers is designed to accomplish this. The Compensation Committee considers the implications of the risks associated with our compensation policies and practices. Named Executive Officers and directors are not permitted to engage in the short selling of, or sell call options or buy put options in respect of, the securities of the Company except as may be permitted under the provisions of the British Columbia Business Corporations Act (the “BCBCA”) and applicable securities laws.

| 12 |

Components of Compensation Package

Compensation for the executive officers is composed primarily of three components: base compensation, performance bonuses and the granting of Options.

Determining Compensation

Our Board is responsible for ensuring that the Company has in place an appropriate plan for executive compensation ensuring that total compensation paid to all executive officers is fair and reasonable and is consistent with the Company’s compensation philosophy and in line with industry practice.

Our Board and Compensation Committee review the performance of the executive officers and consider a variety of factors, when determining compensation levels. These factors, which are informally discussed by the Board and Compensation Committee, include the long-term interests of the Company and its Shareholders, the financial and operating performance and objectives of the Company and each executive officer’s individual performance, contribution towards meeting corporate objectives, responsibilities and length of service. Our Board believes that the compensation arrangements for the Company’s executive officers are commensurate with the executive officer’s position, experience and performance. The directors and Compensation Committee of the Company will continue to review compensation philosophy to ensure that the Company is competitive and that compensation is consistent with the performance of the Company.

Risk-Management Implications

The Compensation Committee exercises discretion in relation to compensation and the allocation of ‘at-risk’ compensation (being cash bonuses and securities-based compensation), to encourage and reward performance that advances the Company’s strategic objectives while mitigating the Company’s exposure to business and financial risks including those identified in the Company’s Annual Information Form and Management’s Discussion and Analysis. The nature of the business and the competitive environment in which the Company operates requires some level of risk-taking to achieve growth. The following aspects of the Company’s executive compensation program are designed to encourage practices and activities that should enhance long-term value and sustainable growth and limit incentives that could encourage inappropriate or excessive risk-taking:

| · | an annual cash bonus target, determined as a percentage of an executive’s annual salary, that may be earned in a calendar year; |

| · | staged vesting over a three year period of Options granted to executives with a maximum of one-third vesting per annum; and |

The Compensation Committee regularly considers risks associated with the Company’s compensation policies and practices. The Compensation Committee has not identified compensation policies or practices that are reasonably likely to have a material adverse effect on the Company.

Compensation Mix

The Company compensates its executive officers through base salary, cash bonuses, the award of Options under the Company’s Option Plan at levels which the Compensation Committee believes are reasonable in light of the performance of the Company under the leadership of the executive officers. The objective of the compensation program is to provide a combination of short, medium and long term incentives that reward performance and also are designed to achieve retention of high-quality executives. For the year ended December 31, 2022, a bonus of $50,000 was paid to Allen Davidoff, Chief Executive Officer in recognition of corporate milestones met.

| 13 |

The following table provides an overview of the elements of the Company’s compensation program.

| Compensation Element | Award Type | Objective | Key Features |

| Base Salary | Salary | Provides a fixed level of regularly paid cash compensation for performing day-to-day executive level responsibilities. | Recognizes each officer’s unique value and historical contribution to the success of the Company in light of salary norms in the industry and the general marketplace. |

| Annual Cash Bonuses | Annual non-equity incentive plan | Motivates executive officers to achieve key corporate objectives by rewarding the achievement of these objectives. | Discretionary cash payments recommended to the Board by the Compensation Committee based upon contribution to the achievement of corporate objectives and individual performance. |

| Long-Term Incentives | Option- based awards | Long-term, equity-based, incentive compensation that rewards long-term performance by allowing executive officers to participate in the long-term appreciation of the Company’s Common Shares. The Compensation Committee believes that the granting of Options is required in order for the Company to be competitive with its peers from a total remuneration standpoint and to encourage executive officer retention. | Annual and special incentive stock option awards granted as determined by the Board, typically based on recommendations from the Compensation Committee. Options are granted at market price, generally vest equally over 36 months and have a term of five years. |

The Named Executive Officers are also eligible to participate in the same benefits offered to all full-time employees. The Company does not view these benefits as a significant element of its compensation structure but does believe that they can be used in conjunction with base salary to attract, motivate and retain individuals in a competitive environment.

Assessment of Compensation

In determining appropriate levels of executive compensation, the Compensation Committee utilizes publicly available compensation surveys and information contained within annual proxy circulars. The Compensation Committee also takes into account recommendations made by the Chief Executive Officer in respect of the Named Executive Officers (other than himself). In reviewing comparative data, the Compensation Committee does not engage in benchmarking for the purposes of establishing compensation levels relative to any predetermined point. In the Compensation Committee’s view, external and third-party survey data provides an insight into external competitiveness, but is not an appropriate single basis for establishing compensation levels. This is primarily due to the differences in the size, scope and location of operations of comparable corporations and the lack of sufficient appropriate matches to provide statistical relevance.

Salary: Base salary is intended to compensate core competences in the executive role relative to skills, experience and contribution to the Company. Base salary provides fixed compensation determined by reference to competitive market information. The Compensation Committee believes that salaries should be competitive and, as such, should provide the executive officers with an appropriate compensation that reflects their level of responsibility, industry experience, individual performance and contribution to the growth of the Company. The 2022 base salaries of the Named Executive Officers of the Company disclosed in the “Summary Compensation Table”, were established primarily on this basis.

Annual Cash Bonuses: Bonuses are paid at the discretion of the Board on recommendation of the Compensation Committee, based upon the performance of the individual, achievement of corporate objectives and the individual executive’s contribution thereto. Bonuses awarded by the Compensation Committee are intended to be competitive with the market while rewarding executive officers for meeting qualitative goals, including delivering near-term financial and operating results, developing long-term growth prospects, improving the efficiency and effectiveness of business operations and building a culture of teamwork focused on creating long-term shareholder value. Consistent with the flexible nature of the annual bonus program, the Compensation Committee determines on an annual basis the goals of management and the weighting of such goals in determining annual bonuses. The Board can exercise discretion to award compensation absent attainment of a pre-determined performance goal, or to reduce or increase the size of a bonus award. To date, the Board has not exercised its discretion to award a bonus absent attainment of applicable performance goals. The Compensation Committee considers not only the Company’s performance during the year with respect to the qualitative goals, but also with respect to market and economic trends and forces, extraordinary internal and market-driven events, unanticipated developments and other extenuating circumstances. In sum, the Compensation Committee analyzes the total mix of available information on a qualitative, rather than quantitative, basis in making bonus determinations. Target bonuses for Named Executive Officers may be exceeded if an executive officer is instrumental in the achievement of favourable milestones in addition to pre-determined objectives, and in circumstances where an executive’s individual commitment and performance is exceptional.

| 14 |

Long-Term Incentives: The allocation of Options, and the terms thereof, are integral components of the compensation package of the executive officers of the Company. The Company’s Option Plan is in place for the purpose of providing equity-based compensation to its officers, employees and consultants. The Compensation Committee believes that the grant of Options to the executive officers serve to motivate achievement of the Company’s long-term strategic objectives and the result will benefit all shareholders of the Company. Options are awarded to employees of the Company (including the directors and Named Executive Officers) by the Board based in part upon the recommendation of the Compensation Committee, which bases its recommendations in part upon recommendations of the Chief Executive Officer relative to the level of responsibility and contribution of the individuals toward the Company’s goals and objectives.

To date, Options granted to Named Executive Officers vest equally over 36 months. The Compensation Committee exercises its discretion to adjust the number of Options awarded based upon its assessment of individual and corporate performance and the anticipated future hiring requirements of the Company. Also, the Compensation Committee considers the overall number of Options that are outstanding relative to the number of outstanding Common Shares of the Company and the overall number of Options held by each individual optionee relative to the number of Options that are available under the Option Plan in determining whether to make any new grants of Options and the size of such grants. The granting of specific Options to Named Executive Officers are generally reviewed by the Compensation Committee for recommendation to the Board for final approval.

| 15 |

Performance Analysis

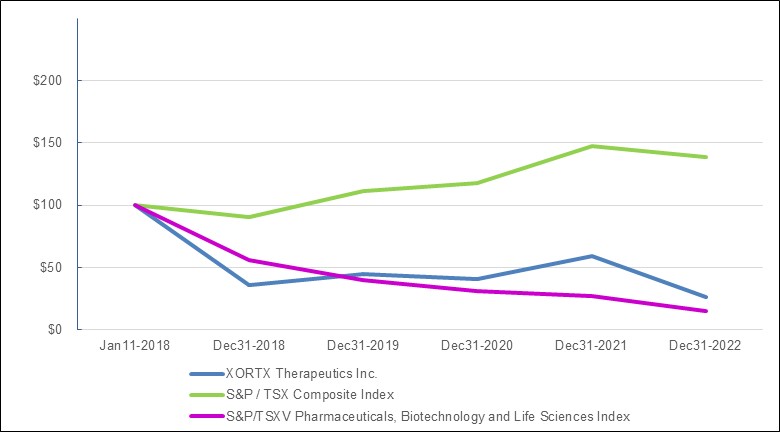

The following graph compares the yearly change in the cumulative total shareholder return since January 11, 2018, being the first trading date following the closing of the Company’s reverse take-over and acquisition of all of the issued and outstanding shares of XORTX Pharma Corp. to form XORTX, assuming an investment of C$100 was made on January 11, 2018 in the Common Shares, with the cumulative total return of the S&P/TSX Composite Index and the S&P/TSXV Pharmaceuticals, Biotechnology and Life Sciences Index for the comparable period.

The Compensation Committee reviews and recommends to the Board the remuneration of the Company’s Named Executive Officers. The Compensation Committee’s recommendations are based on a number of factors, including the Company’s performance as measured by the advancement of business objectives, which performance is not necessarily reflected in the trading price of the Common Shares on the TSXV and Nasdaq. The trading price of the Common Shares on the TSXV and Nasdaq is subject to fluctuation based on a number of factors, many of which are outside the control of the Company. These include, but are not limited to, conditions affecting the technology and life sciences markets, global economic conditions, fluctuations and volatility in foreign exchange rates, changes in government and legislation, and other factors, some of which are disclosed and discussed under the heading “Risks Related to the Business” in the Company’s most recently filed annual and interim Management’s Discussion and Analysis and under the heading “Risk Factors” in the most recently filed Annual Information Form of the Company, all of which are available for viewing under the Company’s profile at www.sedar.com.

Compensation Governance

The Company’s executive compensation program is administered by the Compensation Committee, which is comprised solely of independent directors. During the fiscal year ended December 31, 2022, the Compensation Committee was comprised of Messrs. Ian Klassen (Chair), William Farley and Paul Van Damme. Each member of the Compensation Committee is independent, as defined by applicable securities legislation, and is experienced in dealing with compensation matters by virtue of having previously held senior executive or similar positions requiring such individuals to be directly involved in establishing compensation philosophy and policies and in determining overall compensation of executives.

| 16 |

As part of its mandate, the Compensation Committee reviews and recommends to the Board the remuneration of the Company’s senior executive officers. The Compensation Committee is also responsible for reviewing the Company’s compensation policies and guidelines generally. During 2022, the Compensation Committee held three formal meetings and several informal meetings to address compensation matters including matters relating to hiring decisions and option awards.

The Compensation Committee has a written mandate that sets out the Compensation Committee’s structure, operations, and responsibilities. Among other things, the mandate requires the Board to appoint to the Compensation Committee three or more directors who meet the independence and experience requirements of applicable securities laws and stock exchange policies, as determined by the Board. The chair of the Compensation Committee may be designated by the Board or, if it does not do so, the members of the Compensation Committee may elect a chair by majority vote. Decisions at Committee meetings are decided by a majority of votes cast. The mandate also grants the Compensation Committee access to officers, employees and information of the Company and the authority to engage independent counsel and advisors as it deems necessary to perform its duties and responsibilities. The mandate of the Compensation Committee is available on the Company’s website at https://www.xortx.com/investors/corporate-governance.

Summary Compensation Table

The following table (presented in accordance with National Instrument Form 51-102F6 Statement of Executive Compensation) sets forth all annual and long term compensation for services in all capacities to the Company for the three most recently completed financial years of the Company in respect of the following individuals (each, a “Named Executive Officer” or “NEO”):

| (a) | each individual who acted as CEO or CFO for all or any portion of the most recently completed financial year; |

| (b) | each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, (other than the CEO and the CFO), whose total compensation was, individually, more than $150,000 for the most recently completed financial year; and |

| (c) | any individual who would have satisfied these criteria but for the fact that the individual was neither an executive officer of the Company, nor acting in a similar capacity, at the end of the most recently completed financial year. |

| 17 |

The following table presents the compensation awarded to, earned by or paid to each Named Executive Officers for the years ended December 31, 2022, 2021 and 2020 after giving effect to the Share Consolidation. The Company does not have compensation in the form of share-based awards (other than Options), non-equity incentive plan compensation or non-qualified deferred compensation.

| Name and Principal Position |

Year | Salary ($) |

Share Based Awards ($) |

Option- Based Awards (1)(2) ($) |

Non-Equity Incentive Plan Compensation |

Pension Value ($) |

All Other Comp-ensation(4) ($) |

Total Comp-ensation ($) | |

| Annual Incentive Plans(3) ($) |

Long-Term Incentive Plans ($) | ||||||||

| Allen Davidoff(5) | 2022 | 435,618 | Nil | 81,116 | 50,000 | Nil | Nil | 4,750 | 571,484 |

| President and Chief | 2021 | 221,840 | Nil | 63,072 | 25,000 | Nil | Nil | Nil | 309,912 |

| Executive Officer | 2020 | 196,097 | Nil | 63,072 | Nil | Nil | Nil | Nil | 259,169 |

| Amar Keshri(6) | 2022 | 211,603 | Nil | 32,150 | 3,000 | Nil | Nil | Nil | 246,753 |

| Chief Financial Officer | 2021 | 85,000 | Nil | 17,446 | Nil | Nil | Nil | Nil | 102,446 |

| 2020 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |

| James Fairbairn | 2022 | 58,500 | Nil | Nil | Nil | Nil | Nil | Nil | 58,500 |

| Former Chief Financial Officer | 2021 | 58,500 | Nil | Nil | Nil | Nil | Nil | Nil | 58,500 |

| 2020 | 30,000 | Nil | 15,635 | Nil | Nil | Nil | Nil | 45,635 | |

| Stephen Haworth(7) | 2022 | 299,912 | Nil | 32,150 | 12,500 | Nil | Nil | Nil | 344,562 |

| Chief Medical Officer | 2021 | 106,366 | Nil | 17,446 | Nil | Nil | Nil | Nil | 124,812 |

| 2020 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |

Notes:

| (1) | Represents Options to purchase Common Shares of the Company, with each option upon exercise entitling the holder to acquire one Share. The grant date fair value has been calculated in accordance with Section 3870 of the CPA Canada Handbook. The value of option-based awards was determined using the Black-Scholes option pricing model. These Options were granted, and the Company’s Share trading price is reported in, Canadian dollars. All amounts above are in CDN$, calculated using the currency rates in effect on the date of grant. |

| (2) | The actual value of the Options granted to the Named Executive Officers will be determined based on the market price of the Common Shares at the time of exercise of such Options, which may be greater or less than grant date fair value reflected in the table above. See “Outstanding Share-Based and Option-Based Awards - Named Executive Officers”. |

| (3) | Annual Incentive Plan amounts represent discretionary cash bonuses earned in the year noted but paid in the following year. See “Compensation Discussion and Analysis”. |

| (4) | “Nil” indicates perquisites and other personal benefits did not exceed C$50,000 or 10 percent of the total of the annual salary of the Named Executive Officer during the reporting period. “All Other Compensation” includes perquisites and other benefits including vehicle allowance, parking, life insurance premiums and club membership fees. |

| (5) | Allen Davidoff was appointed as Chief Executive Officer on January 9, 2018. |

| (6) | Amar Keshri was appointed as Chief Financial Officer on July 14, 2021 replacing James Fairbairn who had held the position of Chief Financial Officer from November 5, 2018. |

| (7) | Stephen Haworth was appointed as Chief Medical Officer on July 14, 2021. |

| 18 |

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information with respect to all outstanding Options granted under the Option Plan to the Named Executive Officers, as at December 31, 2022.

| Option-Based Awards | Share-based Awards | ||||||

|

Number of Options (#)(1) |

Option Price |

Option Expiration Date |

Value of (C$) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share- based awards that have not vested ($) |

Market or payout value of vested share- based awards not paid out or distributed ($) | |

| Allen Davidoff |

42,589 20,000 94,822 |

1.64 2.54 1.60 |

Jun 23, 2025 Jan 12, 2027 Jun 06, 2027 |

Nil

|

N/A | N/A | N/A |

|

Amar Keshri

|

21,294 10,000 20,000 |

2.41 2.54 1.38 |

Jul 14, 2026 Jan12, 2027 Nov 25, 2027 |

Nil

|

N/A

|

N/A

|

N/A

|

|

Stephen Haworth

|

21,294 10,000 20,000 |

2.41 2.54 1.38 |

Jul 14, 2026 Jan12, 2027 Nov 25, 2027 |

Nil

|

N/A

|

N/A

|

N/A

|

Notes:

| (1) | Options granted to Named Executive Officers are typically subject to equal vesting over 36 months. |

| (2) | Calculated based on the closing price of the Company’s Common Shares of C$1.12 on December 31, 2022, the last trading day of the financial year and assumes 100% of the Options were vested. |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth information in respect of the value of awards under the Option Plan to the Named Executive Officers of the Company that vested during the financial year ended December 31, 2022 and bonuses awarded to Named Executive Officers, for the financial year ended December 31, 2022.

| Name | Option-Based Awards - Value Vested During Year (1)(2) (C$) |

Share-Based Awards - Value Vested During Year (C$) |

Non-Equity Incentive Plan Compensation- Value Earned During Year (C$) |

| Allen Davidoff | N/A | N/A | 50,000 |

| Amar Keshri | N/A | N/A | 3,000 |

| Stephen Haworth | N/A | N/A | 12,500 |

Notes:

| (1) | This amount is the dollar value that would have been realized if the Options held by such individual had been exercised on the vesting date(s). This amount is computed by obtaining the difference between the market price of the underlying securities at exercise and the exercise or base price of the Options under the option-based award on the vesting date. |

| (2) | This amount is the dollar value realized computed by multiplying the number of Common Shares by the market value of the underlying Common Shares on the vesting date. |

Pension Plan Benefits

The Company has not established a pension plan for the benefit of its executive officers that provides for payments or benefits at, following, or in connection with retirement.

Deferred Compensation Plans

The Company does not have any deferred compensation plans relating to a Named Executive Officer.

| 19 |

NEO Employment Agreements and Termination and Change of Control Benefits

NEO Employment Agreements

Allen Davidoff, CEO

The Company employs Dr. Allen Davidoff as the Company’s President and CEO at an annual salary of US$321,000, pursuant to an employment agreement (the “Davidoff Agreement”) dated January 1, 2018, between the Company and Dr. Allen Davidoff, as amended. The Davidoff Agreement contains standard confidentiality and non-compete clauses and has an indefinite term. The Davidoff Agreement can be terminated by Dr. Davidoff or the Company by providing 30 days’ notice. In the case of the Company providing termination notice, Dr. Davidoff would receive the equivalent of six times his then current monthly salary in a lump sum payment if terminated prior to the first anniversary and if after the first anniversary, Dr. Davidoff is entitled to a lump sum payment of 12 times his then current monthly salary. In the case of a change of control, the Davidoff Agreement provides for a lump sum payment equal to 12 times his monthly base salary amount in effect at the time. As well, all unvested Options then held by Dr. Davidoff shall be deemed to have vested upon any such termination.

Amar Keshri, CFO

The Company employs Amar Keshri as the Company’s Chief Financial Officer at an annual salary of $205,540, pursuant to an employment agreement (the “Keshri Agreement”) dated November 1, 2021, as amended. The Keshri Agreement provides for a discretionary bonus up to 30% of the annual salary and contains standard confidentiality and non-compete clauses and has an indefinite term. The Keshri Agreement can be terminated by Mr. Keshri or the Company by providing 30 days’ notice. In the case of the Company providing termination notice, Mr. Keshri would receive the equivalent of six times his then current monthly salary in a lump sum payment if terminated prior to the first anniversary and if after the first anniversary, Mr. Keshri is entitled to a lump sum payment of 12 times his then current monthly salary. In the case of a change of control, the Keshri Agreement provides for a lump sum payment equal to 12 times his monthly base salary amount in effect at the time.

Stephen Haworth, CMO

Stephen Haworth, the Company’s CMO, provides his services to the Company in accordance with the terms of an independent contractor agreement through his holding company called Haworth Biopharmaceutical Consulting Services Inc. (the “Haworth Agreement”) dated July 1, 2021, as amended. The Haworth Agreement contains standard confidentiality clauses and sets out a monthly retainer of US$20,062.50 per month for the services of Stephen Haworth with a discretionary bonus of up to 30% of the total value of the contract, subject to the discretion of the Company’s Compensation Committee. The Haworth Agreement can be terminated by the Company by providing 30 days’ notice. The Haworth Agreement does not provide for change of control benefits.

The Company’s Option Plan agreements, including those agreements with the Named Executive Officers, contain a provision that if a Change of Control occurs, all Option shares subject to outstanding Options will become vested, whereupon such Options may be exercised in whole or in part subject to the approval of the TSXV, if necessary.

| 20 |

Termination and Change of Control Benefits

The Company does not have in place any pension or retirement plan. The Company has not provided compensation, monetary or otherwise, during the preceding fiscal year, to any person who now acts or has previously acted as a NEO of the Company. In connection with or related to the retirement, termination or resignation of such person and the Company has provided no compensation to such persons as a result of change of control of the Company, its subsidiaries or affiliates. Under the current NEO employment arrangements, if a severance payment triggering event were to occur, the severance payments that would be payable to each of the NEOs is as outlined in the following table.

| Name | Termination by the Company ($) |

Change of Control ($) |

| Allen Davidoff (1) | 430,140 | 430,140 |

| Amar Keshri | 205,540 | 205,540 |

| Stephen Haworth (1) | Nil | Nil |

| Total | 635,680 | 635,680 |

| Note: (1) Converted 1.34 US to Canadian exchange. | ||

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Equity Compensation Plan Information

The following table sets forth aggregated information as at December 31, 2022 with respect to compensation plans of the Company under which equity securities of the Company are authorized for issuance.

| Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (#) |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights ($) |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (#) (1) |

| Equity compensation plans approved by Shareholders (2)(3) | 1,154,319 | $2.42 | 644,650 |

| Equity compensation plans not approved by Shareholders | Nil | Nil | Nil |

| Total | 1,154,319 | $2.42 | 644,650 |

Notes:

| (1) | The Option Plan is a “rolling” option plan whereby the maximum number of Common Shares that may be reserved for issuance pursuant to the Option Plan will not exceed 10% of the issued Common Shares of the Company at the time of the stock option grant. |

| (2) | As at May 16, 2023, 1,039,335 Options are outstanding, with 759,634 Options remaining available for issuance under the Option Plan. |

Burn Rate

The Company’s annual burn rate under the share-based payment compensation plans for each of the three most recently completed financial years are as follows:

| 2020 (1) | 2021 | 2022 | |

| Options | 523,850 | 593,291 | 1,154,319 |

| Options burn rate | 7.6% | 4.6% | 6.4% |

|

Note: (1) Adjusted to reflect the 11:74:1 share consolidation that occurred September 24, 2021. | |||

| 21 |

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS

As of December 31, 2022, there was no indebtedness of any director or officer of the Company or of any proposed nominee for election as a director of the Company to, or guaranteed or supported by, the Company or any subsidiary thereof either pursuant to an employee stock purchase program or any other programs of the Company or a subsidiary or otherwise.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Other than as disclosed in this Management Information Circular, management of the Company is not aware of any material interest of any director or nominee for director or executive officer or anyone who has held office as such since the beginning of the Company’s last financial year or of any associate or affiliate of any of the foregoing in any matter to be acted on at the Meeting.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

As of May 16, 2023, no director or executive officer of the Company who beneficially owns, or controls or directs, directly or indirectly more than 10% of the outstanding Common Shares or any known associate or affiliate of such persons, has or has had any material interest direct or indirect, in any transaction or in any proposed transaction that has materially affected or is reasonably expected to material affect the Company.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Board and senior management of the Company consider good corporate governance to be central to the effective and efficient operation of the Company.

The following provides information with respect to the Company’s compliance with the corporate governance requirements of the Canadian Securities Administrators set forth in NI 58-101 and Form 58-101F1 – Corporate Governance Disclosure.

Board of Directors

The Board believes that it functions independently of management and reviews its procedures on an ongoing basis to ensure that it is functioning independently of management. In-camera sessions, without management and non-independent directors present, are held after most meetings of the Board, or as circumstances require. When conflicts arise, interested parties are precluded from voting on matters in which they may have an interest. The Board discharges its responsibilities directly and through the committees of the Board: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee (the “CGN Committee”), all of which are comprised of three independent Board members. Each committee of the Board operates under a formal charter or mandate which is reviewed, and updated as necessary, on an annual or more frequent basis. In fulfilling its responsibilities, the Board delegates day-to-day authority to management of the Company, while reserving the ability to review management decisions and exercise final judgement on any matter. In accordance with applicable legal requirements and historical practice, all matters of a material nature are presented by management to the Board for approval.

The Board is currently comprised of seven directors, 86% of which are independent (within the meaning of Section 1.4 of NI 52-110 – Audit Committees), effective as of the date of this Management Information Circular. NI 58-101 defines an "independent director" as a director who has no direct or indirect "material relationship" with the issuer. A "material relationship" is a relationship which could be, in the view of the board of directors of a company, reasonably expected to interfere with the exercise of a member's independent judgment. Each of William Farley, Anthony Giovinazzo, Ian Klassen, Jacqueline Le Saux, Raymond Pratt and Paul Van Damme are considered to be independent within the meaning of NI 58-101. Allen Davidoff, the Company’s President and CEO is not independent, as he is an officer of the Company.

| 22 |

The Board meets formally on an as needed basis to review and discuss the Company’s business activities, and to consider and if thought fit, to approve matters presented to the Board for approval, and to provide guidance to management. In addition, management informally provides updates to the Board between formal meetings. In general, management consults with the Board when deemed appropriate to keep it informed regarding the Company’s affairs. The Board facilitates the exercise of independent supervision over management through these various meetings.

The Board has determined that the current constitution of the Board is appropriate for the Company’s current stage of development. The Board has free access to the Company’s external auditors, legal counsel and to any of the Company’s officers.

Other Public Company Directorships

The directors listed below are presently directors of other reporting issuers.

| Director | Other Reporting Issuers |

| William Farley | Globestar Therapeutics Corporation |

| Anthony Giovinazzo | Titan Medical Inc. |

| Ian Klassen | Grande Portage Resources Ltd., GMV Minerals Inc. and ExEBlock Technology Corporation |

Participation of Directors in Board Meetings

In the year ended December 31, 2022, four board meetings, four Audit Committee meetings, three Compensation Committee meetings and two CGN Committee meetings were held. The table below outlines attendance by each director nominated for election as a director at the Meeting.

| Director |

Attendance / Number of Board Meetings |

Attendance / Number of Audit Committee Meetings |

Attendance / Number of Compensation Committee Meetings |

Attendance / Number of CGN Committee Meetings |

| Allen Davidoff (1) | 4 / 4 | N/A | N/A | N/A |

| William Farley | 4 / 4 | N/A | 3 / 3 | 2 / 2 |

| Anthony Giovinazzo (2) | 3 / 3 | N/A | N/A | N/A |

| Ian Klassen | 4 / 4 | 4 / 4 | 3 / 3 | N/A |

| Jacqueline Le Saux | 4 / 4 | 4 / 4 | N/A | 2 / 2 |

| Raymond Pratt | 4 / 4 | N/A | N/A | 2 / 2 |

| Paul Van Damme | 4 / 4 | 4 / 4 | 3 / 3 | N/A |

Notes:

| (1) | Allen Davidoff is not a member of any sub-committee of the Board as he is not independent for the purposes of NI 52-110. |

| (2) | Anthony Giovinazzo was appointed as a director on June 3, 2022. |

Orientation and Continuing Education

Historically, members of the Board who have been nominated and elected as directors are familiar with the Company and the nature of its business. The Company has established a thorough directors handbook for the purposes of onboarding new directors, providing for their initial education on the Company’s policies and their responsibilities as directors, as well as providing for their ongoing director educational requirements. Additionally, the Company’s legal counsel provides correspondence so that directors are up to date with developments in relevant corporate and securities law matters.

Ethical Business Conduct

The Board and senior management of the Company consider good corporate governance to be central to the effective and efficient operation of the Company.

| 23 |

The Board is committed to a high standard of corporate governance practices and believes that this commitment is not only in the best interest of the shareholders, but that it also promotes successful decision making at the Board level. The Board has adopted the Code of Conduct to encourage and promote a culture of ethical business conduct amongst the directors, officers, employees and consultants of the Company. The Code of Conduct is available on the Company’s website at https://www.xortx.com/investors/corporate-governance.

The Board encourages and promotes an overall culture of ethical business conduct by promoting compliance with applicable laws, rules and regulations, and advocating awareness of the guidelines and policies detailed in the Code of Conduct. Through its meetings with management and other informal discussions with management, the Board believes the Company's management team likewise promotes and encourages a culture of ethical business conduct throughout the Company's operations, and the management team is expected to monitor the activities of the Company's employees, consultants and agents in that regard.

Nomination of Directors

The Board, the CGN Committee and the individual directors hold the responsibility for the nomination and assessment of new directors. When presenting shareholders with a slate of nominees for election, the Board considers the following:

| · | the competencies and skills necessary for the Board as a whole to possess; |

| · | the competencies and skills necessary for each individual director to possess; |

| · | competencies and skills which each new nominee to the Board is expected to bring; and |

| · | whether the proposed nominees to the Board will be able to devote sufficient time and resources to the Company. |

The Board also recommends the number of directors on the Board to shareholders for approval, subject to compliance with the requirements of the BCBCA and the Company's articles and by-laws. Between annual shareholder meetings, the Board may appoint directors to serve until the next annual shareholder meeting, subject to compliance with the requirements of the BCBCA. Individual directors are responsible for assisting the Board in identifying and recommending new nominees for election to the Board, as needed or appropriate.

The Board will periodically assess the appropriate number of directors on the Board and whether any vacancies on the Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, or the size of the Board is expanded, the Board will consider various potential candidates to serve as director to the Company. Candidates may come to the attention of the Board through current directors or management, shareholders or other persons. These candidates will be evaluated at a regular or special meeting of the Board, and may be considered at any point during the year.

Audit Committee

The Company’s Audit Committee is comprised of three directors: Paul Van Damme (Chair), Ian Klassen and Jacqueline Le Saux, all of whom are considered financially literate and independent (as such terms are defined in NI 52-110). The relevant education and experience of the members of the Audit Committee is included below.

During the year ended December 31, 2022, the Audit Committee held four meetings. The Audit Committee is responsible for the Company’s financial reporting process and the quality of its financial reporting. The Audit Committee is charged with the mandate of providing independent review and oversight of the Company’s financial reporting process, the system of internal control and management of financial risks, and the audit process, including the selection, oversight and compensation of the Company’s external auditors. The Audit Committee also assists the Board in fulfilling its responsibilities in reviewing the Company’s process for monitoring compliance with laws and regulations and its own code of business conduct. In performing its duties, the Audit Committee maintains effective working relationships with the Board, management, and the external auditors and monitor the independence of those auditors. The Audit Committee is also responsible for reviewing the Company’s financial strategies, its financing plans and its use of the equity and debt markets.

| 24 |

The full text of the charter of the Company’s Audit Committee is attached hereto as Schedule B and is available on the Company’s website at https://www.xortx.com/investors/corporate-governance.

Composition of the Audit Committee

The Company’s Audit Committee is comprised of three directors: Paul Van Damme (Chair), Ian Klassen and Jacqueline Le Saux, all of whom are considered financially literate and independent (as such terms are defined in NI 52-110).

Relevant Education and Experience

Paul Van Damme (Chair) – Paul Van Damme is a Chartered Professional Accountant with over 45 years business experience. He holds a Bachelor of Commerce degree from the University of Toronto and a MBA from the Rotman School of Management. He is an experienced accountant having worked for Pricewaterhouse Coopers in their Toronto and London, UK offices and he has held the position of CFO with a number of Canadian and US private and public companies including Allelix Biopharmaceuticals Inc., Vasogen Inc. and Structural Genomics Consortium, a UK-based charity. Mr. Van Damme is financially literate and an independent director of the Company for the purpose of NI 52-110.

Ian Klassen – Mr. Klassen has close to 30 years of business experience in the administration of public companies and finance. He is the current President and CEO of two gold exploration companies listed on the TSXV and was a founding director of Canabo Medical Corp., a public company that completed a business combination with Aleafia Health Inc. in March 2018. He has extensive experience chairing governance, audit, risk assessment and compensation committees. Mr. Klassen has a B.A. (Honours) from the University of Western Ontario. Mr. Klassen is financially literate and an independent director of the Company for the purpose of NI 52-110.

Jacqueline Le Saux - Ms. Le Saux has over 30 years business experience in the public and private markets in the areas of biotechnology, legal compliance and as legal counsel. She is the former Vice President, Legal and Compliance, Purdue Pharma (Canada) from 2009 to 2018, former General Counsel and Corporate Secretary for Patheon Inc. and former Vice President, Corporate and Legal Affairs for Vasogen Inc. Ms. Le Saux is financially literate and an independent director of the Company for the purpose of NI 52-110.

Audit Committee Oversight

Since the commencement of the Company’s most recently completed fiscal year, the Company’s Board has adopted all recommendations of the Audit Committee to nominate or compensate an external auditor.

Audit Fees

The following table provides details in respect of audit, audit related, tax and other fees billed by the external auditor of the Company for professional services rendered to the Company during the financial years ended December 31, 2022 and December 31, 2021:

| Year Ended | Audit Fees ($) |

Audit-Related Fees ($) |

Tax Fees ($) |

All Other Fees ($) |

| December 31, 2022 | 82,400 | 689 | 5,000 | 9,000 |

| December 31, 2021 | 49,000 | 397 | 2,500 | 16,000 |

Audit Fees – aggregate fees billed for professional services rendered by the auditor for the audit of the Company’s annual financial statements as well as services provided in connection with statutory and regulatory filings.

Audit-Related Fees – aggregate fees billed for professional services rendered by the auditor and were comprised primarily of audit procedures performed related to the review of quarterly financial statements and related documents.

| 25 |